My continued rebuttal to C Thomas Thames regarding annuities in general

Tom crossed the line when he wrote among other things that his client "crosses the line when he suggests that only greedy sales people recommend annuities." It is only when you analyze annuities and life insurance products in great detail that you really understand these complex products. Please keep in mind that this rebuttal section really has nothing to do with my review of C Thomas Thames. Tom loves to distract attention away from what he did. If you haven't read my review of Tom then you will DEFINITELY want to read about what he did! That is the main purpose of this website.

Over the years there has been a public uproar of complaints about annuities and "cash value" life insurance products and the non-fiduciary agents who sell them. The debate begs the question, why seek out the services of any broker / adviser / agent who sells so-called "retail investments" like annuities, actively managed mutual funds, whole life, universal life and other expensive and inferior products when the unbiased experts (like Peter Lynch and Warren Buffet) and studies consistently favor plain old index funds (commonly sold as stock and bond ETF's today)? Why deal with conflict of interest? For the record my intent is obviously not to be the reader's personal adviser. I am not a financial, tax or legal adviser so do your own due diligence. I'm an investor who has done a lot of research lately about what respected experts have to say and it's very eye opening. I'll leave it to what the unbiased experts have to say (below). There's endless talk about annuities on the internet but it's very hard to sort through it all because there's no many commission-based "advisers" mucking it up, and so I am re posting what the unbiased experts have to say in order to help educate the public and to serve as my rebuttal. Consumers deserve to hear the truth about annuities from unbiased sources. And if you're wondering why product pushing "advisers" (salesman) never discussed this critical stuff with you then look no further than the lavish commissions of as much as 7 - 20% that agents are paid if and when they can manage to sell these expensive annuity products.

“These [indexed annuity] contracts have really high hidden fees,” said Smetters, a former U.S. Treasury Department economic policy official. “That’s why they’re terrible ideas for older people even though they’re peddled to them.” A GREAT Article by the trusted news source Bloomberg

Bob Blumenfield, who is the California Assembly Budget Committee Chair has said that the sale of annuities is often a “breeding ground for fraud”.

"Low single digit returns of 1-3% which ALL index annuities will return" -- Chris Wang of Runnymead Capital

"Expect [index annuity] returns on par with CD's" -- Chris Wang of Runnymead Capital

"Index annuities are CD return products" -- Stan Haithcock

"Index annuities are poison for your pocketbook" -- Clark Howard, respected consumer advocate and syndicated radio host

"Free meal seminars offered by annuity salespeople are to be avoided at all costs -- unless you want to get indigestion in your wallet for the rest of your life." -- Clark Howard

"There's almost never a circumstance when an annuity is called for" -- Clark Howard, respected consumer advocate

[Equity index annuities] continue to be a terrible investment alternative for almost any investor. If you are a long-term investor and you need investment with the potential for greater return to complement your low-risk assets, equity indexed annuities are a poor choice. -- Page Perry, Atlanta-based securities-related litigation law firm with over 125 years collective experience Forbes Magazine author says "We don't recommend an allocation to annuities for any portion of your portfolio. We believe an age-appropriate allocation to bonds provides a similar boost to the likelihood you will have sufficient assets in retirement."

Financial Adviser Magazine article says "Most financial advisors know that equity-indexed annuities are a seriously flawed product, appropriate for almost no one."

The higher fees of most annuities can often cancel out their tax advantages; most annuities lock in investors for years; and annuities saddle heirs with higher taxes, unlike mutual funds or most other investments. Annuities are almost never appropriate for seniors. -- Wall Street Journal

"If you’ve been pitched an indexed annuity that will average double digit returns or has guarantees at 6, 7, 8% or higher, you need to run, not walk in the other direction from that advisor." -- Annuity Think Tank

What kind of return on investment will you get with an index annuity? According to Chris Wang, a fee-only fiduciary, "low single digit returns of 1-3% which all indexed annuities will return"

"It’s a funny thing about annuities. While they purport to offer protection, safety, and guaranteed income, annuities are, in reality, only as solid as the insurers that stand behind them." -- Jim Cramer from MSNBC's Mad Money

"[Insurance companies that offer annuities] don’t disclose much of anything except what they broadly do, and what they broadly do is disastrous." -- Jim Cramer

"So what to expect down the road with the big annuity providers? Well, that road should be a rocky one in the days ahead." -- Jim Cramer

MSNBC's Jim Cramer recommends FIXED INCOME (namely bonds ala BND) investments -- NOT annuities!!!

"the only people who think equity-indexed annuities are a good idea are those who sell them, usually to unsophisticated seniors after a free steak dinner" -- Whitecoat Investor

"You never ever want to buy an annuity that has a surrender charge" -- consumer advocate and radio host of 30 years, Bob Brinker (to those who insist on buying an annuity)

"Index annuities are the 'poster children' for products that are too good to be true" -- Larry Swedroe

"Almost always, anything that can be done with an annuity can be done a better way" -- Founder of Fisher Investments

"Equity-indexed annuities were put squarely into the Ugly category" -- quote from the book The Only Guide To Alternative Investments You’ll Ever Need

A CRITICAL MUST-READ REPORT According to Chris Wang of Runnymede Capital Management, a fee-ONLY fiduciary firm, with ALL index annuities you can expect returns of only about 1% to 3% when held for at least 10 years! He says that if anyone promises you returns of 6% or more then run for the door.

A CRITICAL MUST-SEE YouTube Video by a fee-ONLY CFP (fee-only means that he earns no commissions when recommending a financial product) - The video description reads: "ANNUITY INCOME GUARANTEE WARNING / 7% ANNUITY INCOME GUARANTEE EXPOSED!

This video exposes the belief that many people have that they can get a 7% guaranteed return with an annuity. It simply is not true and I explain why in this video. For instance, do you realize that if you start one of these programs at age 65 and and die at age 85 your ACTUAL rate of return is less than 3%? It's true." Jeff explains that essentially the insurance companies and sales agents are only talking about annual interest payment rate, rather than what really matters, which is your actual return on investment (after surrender or distribution to heirs)! Very sneaky!

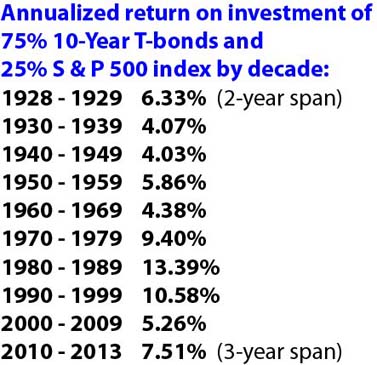

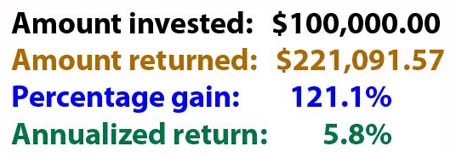

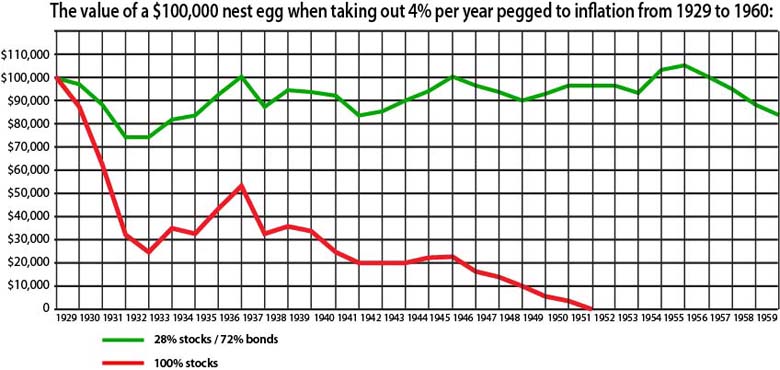

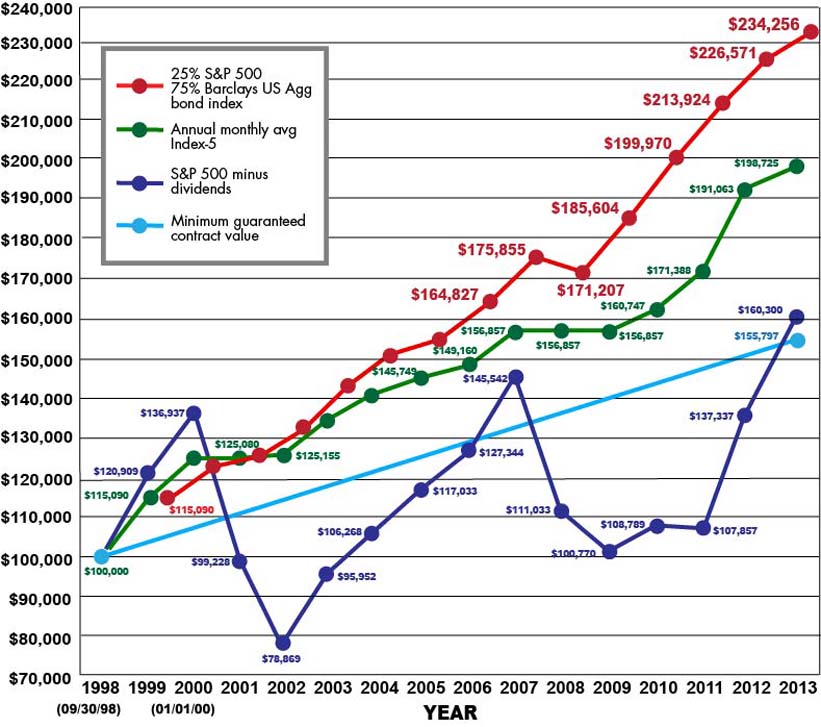

So according to this fee-ONLY CFP, after 20 years the annuity only provided a return of less than 3% AND that's before those nasty, higher ordinary income taxes that apply to annuity gains! Annuity salesmen love to suggest that the open markets (bonds and stocks) are "risky". But just how risky are the open markets? Just as a hypothetical example, has a very conservative 75/25 portfolio (example: ticker symbols VOO and AGG, which are 100% liquid index funds) ever lost money during any decade? I can't find any decade period that even came close! I should note that it makes sense to compare long time periods because annuities are in fact long-term financial products. Note that even during the great depression, the hypothetical 75/25 portfolio provided an average 4.07% annual return on investment. When accounting for deflation, the 75/25 portfolio actually never had lost money year-end at any point even amidst the 1929 market crash. Amazing but true! And during the recent recession from 2000 - 2009 the average annual ROI was 5.26%. And just for fun, if gains were calculated to compound each year, the return on investment for 2000 - 2009 would have been 5.8%. According to Ibbotson, from 1970 to 2010 a portfolio of 28% stocks and 72% bonds provided the lowest risk portfolio. Today, fiduciaries like Ric Edelman seem to be recommending a tad bit more exposure to stocks to those who require low risk. Nevertheless a 25/75 portfolio provides a perfect demonstration of how the open markets are not the great risk that biased product salesmen want the know-nothing investor to think.

What market risk???

Value of $100,000 invested from 2000 through 2013 in

25% S & P index

75% 10-Year T-bonds

Includes simple elementary strategy of annual rebalancing on Jan 1 of every year

Includes simple calendar rebalancing on Jan 1 of every year

Even during the great depression a simple low risk 28/72 mix survived the great depression just fine.....

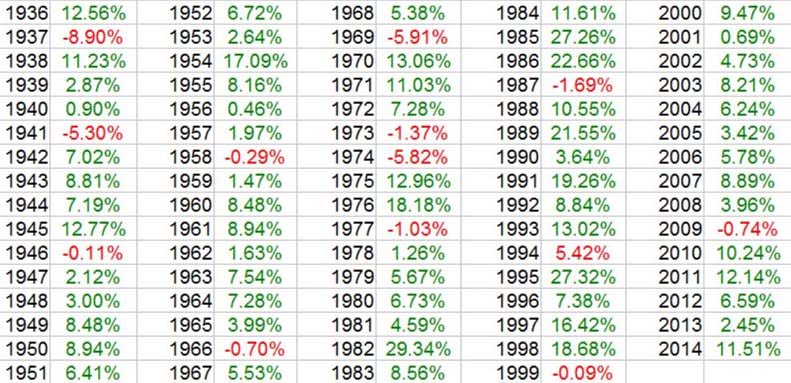

CRITICAL: Don't ever confuse annual interest rate "return" with ROI (return on investment)! A common deception used by commission hungry annuity sales people is to advertise very high rates of "return" (example: "7% Guaranteed Return") that are merely interest rate payments or they might talk about the "protected benefit" value or "income base", all of which are not not ROI!!! The returns by decade displayed above are what really matters -- The actual return on investment numbers!!! What you see above is what you get -- the actual ROI that can be cashed out at any time, for any reason and without penalty. It should be noted that even during the 40's great depression the seemingly low returns of 4.07% were actually better than meets the eye due to deflation. The stock market is also a different beast than it was back then, making a 1929 type crash quite unrealistic.

STOCK / BOND ALLOCATION RATIO IS CRITICAL: From 1970 to 2010 the lowest risk bond / stock allocation ratio was 28% stocks and 72% bonds. This is not opinion. This is fact! (NOTE: This is exactly what insurance companies do with your money: They invest heavily in bonds (70% to 90%) because they know that they can make low return promises and still earn a profit, still pay for their overhead costs and still pay your adviser his monstrous commission.)

THE ART OF DECEPTION: Beware of anyone who tries to use even a 50/50 allocation in order to attempt to characterize bonds and stocks as "too risky". They are being deceptive. Here's how a portfolio of 28% S&P 500 index fund and 72% ten-year treasury bonds would have done going way back to 1936. As you can see it never took "several years" to recover from the occasional and minor stock market downturns, which were few and far between...

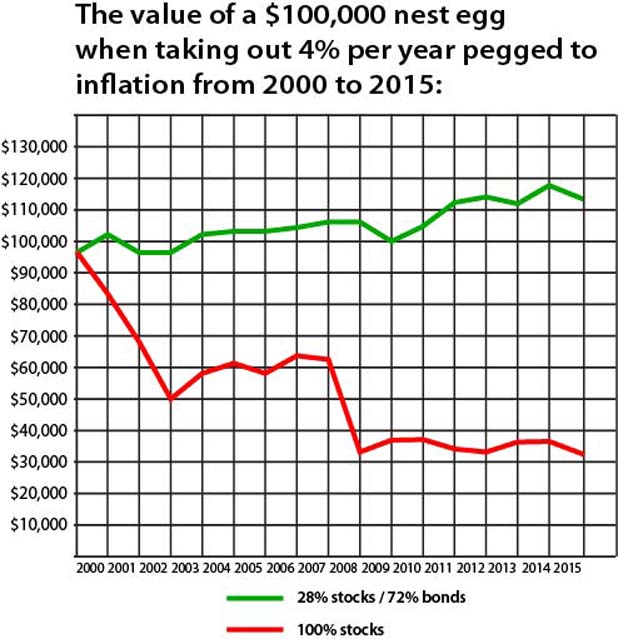

TIME TESTED 4% WITHDRAWAL RATE RULE: The other sneaky deception used by salesmen is to ignore the 4% annual withdrawal rate rule. With a 30 year investing time horizon if you select a low risk allocation (example 28/72) and follow the 4% rule, history says that your money won't run out. In fact even during the worst of times your money should be growing to the point that your 4% withdrawals will increase with inflation! Look no further than the 2000's. Eventually you can take out much much more than what those annuities pay. Annuities such as SPIA's (or immediate annuities) or any other annuity that pays fixed payments for life do not keep pace with inflation!!! By the time you get to be in about your early 80's those fixed payments start to leave you more and more in poverty.

But wait! The free markets get even better!

Over time a portfolio will likely drift from its target allocation (example: 75% AGG / 25% VOO becomes 70/30). According to Vanguard, the simple act of rebalancing adds up to .35% in portfolio value annually. Many investors did just that in 2009. This contrasts with indexed or fixed types of annuities which CANNOT BE REBALANCED! If stocks tank you are STUCK IN THE MUD in that ultra-conservative annuity product!!! You have NO opportunity to take advantage of the inevitable stock market rebound (unless of course you pay a surrender penalty to get out of the annuity, which may be massive).

ARTICLE: Don't let interest rate fears scare you out of bonds. Some annuity salesmen may try to scare you into putting money into an annuity by creating "bond bubble" fears. In reality bonds and stocks balance each other out. Another ARTICLE: Why bond bubble" fears are overblown.

“We estimate that between 15% and 20% of the premium paid by investors in equity-indexed annuities is a transfer of wealth from unsophisticated investors to insurance companies and their sales forces.” -- Craig McCann, Ph.D. and CFA, and Dengpan Luo, Ph.D. and CFA, of Securities Litigation and Consulting Group in Fairfax, VA.

According to William Reichenstein, professor of investments at Baylor University "Indexed annuities tend to underperform a lower-risk strategy of rolling over CDs because of the high cost embedded in these things.” Reichenstein also says that even with interest rates near record lows, CDs may still do better than the annuities because insurers will have to reduce caps on returns to maintain profitability. (Source: Bloomberg )

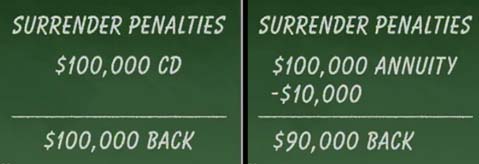

According to Chris Hansen from Dateline NBC annuities have unique LIQUIDITY RISKS. He exposed the fact that with a CD, if you need to get your money back early then you only lose the interest. With annuities you lose much much more. You lose not just the interest but a sizeable portion of your original principal! Also according Dateline NBC no one has ever lost a dime with FDIC-insured deposits. Never.

CALIFORNIANS WITH ANNUITY "GUARANTEES" AT RISK OF 20% LOSS OR MORE!

When I found this out I was stunned! According to this website if the insurance company (that issued your annuity contract) goes bankrupt and it becomes up to the California guarantee fund, then they will ONLY pay 80% not to exceed $250,000. That a LOSS of at least 20%!!! Accordingly I think this is just one more BIG reason why annuities specifically with "guarantees" should never be sold in California. Anyone who says that an annuity doesn't come with unique risks is just plain lying. The very thing of market volatility that investors fear (which is urealistic to begin with as examined above) is the same market volatility that will put insurance companies at risk of insolvency. And I can just hear product pushing annuity salesmen saying "this will never happen". Just Google "Executive Life Insurance Company" to read about a large and reputable insurance company that went belly up and the 62 other major insolvencies that followed! Also AIG became insolvent but dodged a bullet when the government bailed them out -- There is no guarantee that the government will bail out the next failed insurance company. It should be noted that ETF's like SPY and AGG don't have this type of insolvency risk problem that is unique only to annuities. With ETF's your share price is always the share price.

It gets worse! According to Forbes Magazine "Each state does insure annuitants, but this insurance is only as good as the state’s ability to pay in the event of a systemic failure across the entire insurance industry." Therefore you could actually get less than 80% not to exceed $250,000.

Forbes Magazine says "Because of all of these negatives, we suggest you just say 'No' when someone tries to sell you an Equity-Indexed Annuity. Then turn around and run, don’t walk away."

Money Morning article says "Various studies suggest that the purchase of an annuity typically results in a wealth transfer of as much as 15% to 20% from the investors who buy them to the insurance companies and the sales forces who sell them"!!!

DATELINE NBC EXPOSES ANNUITY SALES WITH HIDDEN CAMERAS

Chris Hansen from Dateline NBC (to Catch a Predator) did an undercover investigation of index annuities and the way agents sell them through deception, omission, instilling fear (of normal investments), etc.

Kiplinger - Article about equity index annuities called "An annuity you really should AVOID"

The Wisconsin Office of the Commission of Insurance has stated that the majority of unsuitable annuity sales in Wisconsin go undetected. In other words when an agent tries to make an annuity sale to a customer, the insurance company usually does not catch or stop it.

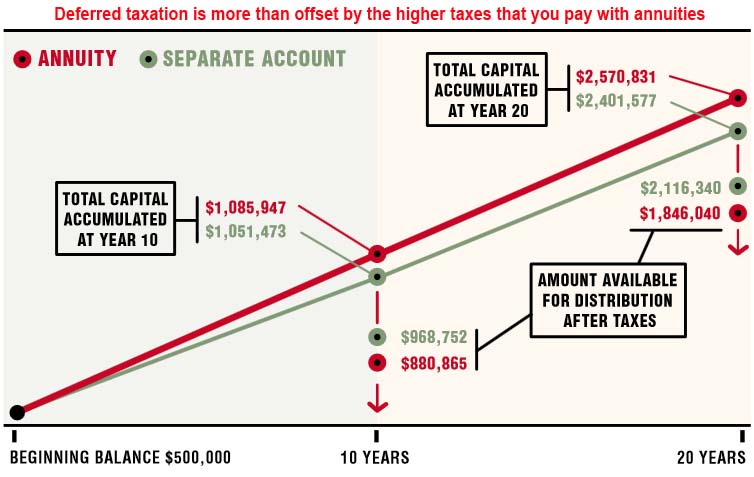

ANNUITIES ARE A TAX DISASTER!

What Mr. Annuity Salesman wont' tell you or will just gloss over: The benefit of deferred taxation is offset and then some by the higher taxes that you will pay once you cash out of that annuity! As described on Wikipedia, a Wealth Manager article determined that annuities are generally NOT effective at tax deferral relative to other investments. So when Mr. Insurance Agent or Mr. Broker tells you that annuities have "deferred taxation" he isn't telling you that later Uncle Sam will make up for it and then some with the much higher ordinary income tax! The article says verbatim "the tax-deferred accumulation feature of annuities is overrated". Another case study also came to the same conclusion that you will do WORSE when invested in an annuity rather than index funds (ETF's), so why would annuities be so aggressively sold? It's the huge commissions.

Another tax disaster: LIFO - "Last In First Out" - When you start to take money out of an annuity, you cannot elect to take out non-taxable money first (if any). It's an IRS rule that TAXABLE money must be taken out first. Uncle Same will start taxing you right away.

Another tax disaster - Annuities have terrible write off ability - Got a big stock loss or other investment loss and want to use it to deduct from your annuity distribution? Sorry folks! You can only deduct $3,000 of losses in one year! That's awful!

Respected fiduciary adviser / radio host Ric Edelman has said on his syndicated radio show that annuities are one of the most expensive of all financial products! Retail annuities have mortality expense charges (usually about 1.2% per year), plus there may be rider fees (possibly 1% - 3% per year), death benefit fee (1% sometimes), and finally the turnover ratio may cost you an extra 1% per year possibly. When all added up, annuities have hidden fees and turnover costs totaling between 3 and 4 percent per year! Go compare that with a portfolio of exchange traded funds (also known as ETF's, "passively managed" mutual funds or "index funds"). There is no comparison. ETF's are vastly cheaper. Unfortunately these high fees are buried in a complex legal book called a "prospectus" that will probably require a lawyer to understand. If you are duped into investing in an annuity, these high fees are not even disclosed in the quarterly statements that you receive.

Ric Edelman says that some product pushing salesmen offer free dinners in what is advertised as as a "free educational seminar". He says that their true goal is to sell you an annuity. He says that the goal is to create guilt.... "I just gave you this free dinner. Now won't you buy this annuity?" He describes the whole thing as "the most expensive free meal you will ever eat"!

Conflict of interest: Annuity sales agents may be highly motivated to sell their clients annuities because of the high commissions that they stand to earn (5 - 6 % on average, but can be much higher) and even trailer fees (for doing absolutely nothing), with little or no regard for the interests of the client.

Huge advertising campaigns from insurance companies and brokers pump up annuities with biased omissions, thus obscuring the truth.

When trying to sell annuities, the most common truth suppression technique used by annuity salesmen is to instill UNrealistic fear of stock market volatility over SHORT time periods ("Tired of stock market ups and downs?") even though annuities are LONG-term investments -- Therefore short term stock market volatility is a red herring.

Annuity salesmen ignore two critical facts: 1) Over long time periods it is extremely unlikely that you will lose your original principal (which is what annuities guarantee), and 2) Normally you simply protect against volatility with DIVERSIFICATION. A conservative investor would not put 100% of their money in stocks (like the S & P 500 index that agents compare annuities with). Insurance companies also like to compare their annuities to the S&P 500 price return index. The problem with this comparison is that the S&P 500 price return index EXCLUDES dividends! The S&P 500 total return index includes dividends which are currently over 2% per year.

SWITCHING TO A SUPER LOW COST VANGUARD ANNUITY

If you are actually considering putting your money into an annuity then the lowest cost option that I've found by far is Vanguard yet Mr Annuity salesman never mentions Vanguard! Why is that? Don't expect Mr. Annuity Salesman to mention Vanguard because Vanguard does not pay out commissions to any agent, adviser or broker. Not paying commissions enables Vanguard to have VASTLY lower fees than the retail products that sales agents and other "advisers" sell. Vanguard annuities are sold directly to the public and this keeps their costs super low. For anyone who doesn't believe me...

According to Vanguard you can CLICK HERE to see how much you will save in just the first year when compared to the expensive retail annuity product that Mr Broker sold you or is trying to sell you.

If you are stuck in an annuity now then once the insurance company surrender period has ended, then vastly lower cost option to consider is to switch to Vanguard in what is known as a tax-free 1035 exchange. That's right... tax free! CLICK HERE to see how much you will save in fees per year. Typically you will save at least 2% per year! Vanguard also has no insurance company surrender fees. That's right... NO surrender fee to get out! Vanguard offers an Immediate Fixed Annuity, an Immediate Variable Annuity and a Deferred Variable Annuity with Guaranteed Lifetime Withdrawal Benefit.

Annuities lack liquidity due to massive tax and insurance company penalties. Meant to be held until at least age 59 1/2. Insurance company surrender penalties apply to the retail annuities that agents sell. Vanguard annuities have NO surrender period and are vastly less expensive than the annuity products that Mr. Insurance Agent pushes on clients.

There is NO WAY to predict whether one might need "rainy day" money in the future, and based on this common sense, illiquid investments such as annuities are terrible investments. Ric Edelman says that there's probably literally a thousand reasons that one might need their money. In Chris Hansen's Dateline NBC undercover story the senior citizen who was sold an index annuity wound up needing money for medical bills for his wife!

Retail annuities usually have back-end insurance company "surrender charges", perhaps 7% in the first year, declining by one percent each year for 8 years. Index annuities may have much much stiffer penalties. Again Vanguard annuities have no insurance company surrender fees because they are sold directly to the public. Insurance agents will never push Vanguard annuities because Vanguard does not pay commissions to any sales agents.

10% Federal withholding tax on withdrawals taken out before age 59 1/2.

1% California withholding tax on withdrawals taken out before age 59 1/2. This according to a statement of mine when I withdrew money from an annuity early. Tax laws may vary or change from year to year.

Annuity loses cannot be written off. This contrasts with normal investments like ETF's and stocks in which losses can be written off come tax time.

Property taxes, stock loses, and other loses generally cannot be used to reduce Federal and State withholding taxes on early withdrawals.

Withdrawals are taxed at the much HIGHER "ordinary income" tax rate. Not the lower capital gains tax rate.

Respected financial planner / radio host Ric Edelman has said on his syndicated radio show that calculating annuity returns is so incredibly complex and complicated that NO investment adviser can possibly understand or come to any conclusion that annuity products are "better" than normal investments like index funds and stocks. So why do they sell an illiquid investment that they can't possibly understand??? Ric says that it must be the huge commission money the adviser stands to earn.

Annuities are constantly under fire and criticized, including by unbiased, objective investment professionals everywhere including syndicated radio host Ric Edelman. According to the NASD, investors made at least 7,000 complaints about variable annuities in 2003 ALONE!

On average annuities have HIGHER management fees of .8% (to over a full percentage point) more than even managed mutual funds. The annual fee on an annuity is always higher than for an equivalent managed investment outside the annuity. In all, management fees are usually .8 % to .9% per year, plus mutual fund fees (.5% - 2% per year). In all, variable annuity fees (including the fees described in the box below) typically cost you 2 1/2% - 4% per year on average whether the account appreciates in value or not!

If you make the mistake of putting your money in an annuity then there will be NO "stepped up" tax basis for your beneficiaries if you die. That means that they will have to pay income taxes on any growth of your annuity that occurred from the time you purchased the annuity. With normal investments like ETF's, your heirs pay NO taxes on those gains that occurred during your lifetime. Yet insurance companies and annuity salesmen actually claim that annuities are advantageous to your heirs simply because you can name beneficiaries and avoid probate. In reality all you need is a last will and testament!

Annuity guarantees against loss of principal go out the window if the annuity is issued by just one insurance company. At some point it is possible that an annuitant might want to allocate their money to a fixed interest earning account within (if they aren't already allocated as such). In doing so they may be putting all of those eggs in that one "basket". Also if an investment adviser picks the wrong annuity and wants their client to surrender the entire annuity, this mistake of putting too many "eggs" in one "basket" becomes a critical one.

In the event of insurance company insolvency, depending on various factors such as the type of annuity you own (variable, fixed, etc) your money may or may not be at the mercy of an insurance fund. There is no guarantee that an insolvent insurance company will be rescued in full or in part by another company or by a government "bailout".

CRITICAL INFORMATION ON INDEX AND FIXED ANNUITIES

ANNUITY ALERT: Annuities are a "safety trap" - According to William Reichenstein, a Baylor University professor who is also an expert witness on annuity products, over the past 44 years a typical index annuity has underperformed a very low risk portfolio of 85% one-month Treasury bills and 15% U.S. large-cap stocks (example: SPY ) by nearly 2% per year! And your money isn't locked away under threat of "contingent deferred sales charge" penalties and Federal and State tax withholding penalties. The 85 / 15 portfolio is liquid! With an annuity your money is locked away for years and years! And of course with the 85 / 15 portfolio your beneficiaries keep their stepped up cost basis. Money Magazine article

Dr. Craig McCann of UCLA and Dr. Dengpan Luo of Yale University conducted a study in which they concluded that investors would be better off in a simple portfolio of U.S. Treasuries and large cap stocks (example: ticker symbol VOO) -- a whopping 97% of the time!

The "tax deferred" feature of annuities is overrated. This study revealed that the effects of ordinary income taxation out pace the tax deferred savings that you get with annuities. After 20 years, with an annuity investment of half a million dollars would have missed out on $724,791 in gains had you just avoided a variable annuity. And this study compared the annuity to an expensive managed separate account. With ETF's the annuity would have been beaten much more. The study speaks to other annuities as well because all annuities are taxed at a higher rate.

Even during the so-called "lost decade" index annuities and fixed annuities were easily beaten by a simple portfolio of 40% S&P 500 stocks and 60% ten-year treasury bonds! Today I could invest in VOO and AGG for less than $20 through any deep discount brokerage firm such as E Trade.

Index annuities were easily beaten even during the "lost decade" of the 2000's

ABOVE: Performance of a simple very low-risk portfolio of 75% Total Bond Market Index and 25% S&P 500 Index from Jan 1, 2000 to Jan 1, 2014 when rebalanced once per year on January 1st. The 75/25 portfolio provided a very consistent and predictable return on investment. The insurance company's claimed index annuity average annual "return" was only 4.3%, which whether true or false is nothing to brag about.

It should also be noted that the Index-5 annuity "returns" above may not even be "cash surrender value" or "death benefit value" in the first place! If so then this insurance company graph cannot be used for comparing returns on investment (ROI). As explained in earlier in this video "income base" or "protected benefit value" is not ROI.

RIC EDELMAN SAYS AVOID ALL ANNUITIES

On his November 24, 2013 radio show, Ric Edelman reiterated that he hates all annuities. When a caller said that he was being urged by an insurance agent / "adviser" to buy a SPIA (Single Premium Immediate Annuity) Ric noted that these products are expensive because you indirectly pay for the broker's 5 - 10% commission. When calculating how much they will pay you in monthly payments, the insurance company has to factor in that commission, their underwriting costs, the mortality fees, etc. Also with a SPIA your principal is gone for life once you lock in that contract. Illiquidity is a no no!

ExpertLaw.com says to beware of brokers and insurance agents who may want to keep switching your money around from annuity to annuity. The author says that the reason is because of the HIGH commissions that brokers earn each time they get you to switch annuities! The author also says that the broker commission received is usually "likened to" the duration of the surrender period. So if the surrender period may happen to be 7 years, which is the average, the commission the broker earns would also be about 6 to 7 percent of the total investment. By the way, the author of this article is an expert witness and consultant for litigation involving securities, insurance, annuities and taxation.

Here's another site that says that the commissions that advisers are paid are "just too wonderful to resist".

Here's another law web site that says that brokers usually earn as much as 7 - 10% when selling annuities. AND brokers get a "trailer fee" over time for doing absolutely nothing. Often that trailer fee is about 1/4% per year. The author says that these high fees and commissions are the reason why brokers push annuities even when they are not appropriate for the investor.

This law web site says that since annuities pay far more sales commissions, it is easy to see why stockbrokers use hard sell techniques. It also speaks about unsuitable annuity sales and switching, and broker failure to disclose critical information to customers.

Clark Howard says avoid "free" advice from commissioned sales people including commissioned insurance salespeople.

The racket known as Whole Life Insurance - While whole life insurance is technically not called an "annuity", it's yet another insurance company product that they try to convince people to sink their money into. CLICK HERE for a very helpful page about the pitfalls.

This great article says the purpose of TERM life insurance is to protect your family for a specific time period. If you buy the right term life insurance, it does the job BEAUTIFULLY WELL.

Yet another great article about whole life. "You can get returns of 2-5% per year on whole life (before inflation) if you hold it for your whole life." That says it all.

Whole life insurance has two purposes... 1) To protect your family, 2) To make insurance companies and agents lots of money!

Another insurance company racket known as Universal Life Insurance is also a lot like an annuity. It's almost like they just gave it a different name. The real truth behind universal life insurance is that you give up control of your money to do two things: insure yourself and save money, and it fails to do either well. This article calls ULI a "rip off with a fancy name"!

Everyone hates Variable Life, Universal Life and Whole Life Insurance:

"Insurance needs to be insurance. Investments need to be investments. You should NEVER combine the two ever, ever, ever!" -- Suze Orman

"You do not purchase insurance for investment purposes." - Ric Edelman

"The hidden fees of insurance policies are more pervasive than in virtually any other product in the market place." - Ric Edelman

"How many times have you heard me say I hate universal live insurance" -- Suzie Orman

"[caller who made the mistake of investing in UL]...a HORRIFIC investment" -- Suzie Orman

"There is not a single independent study, not a single academic journal, not a single objective review that endorses the idea [of investing in a universal life insurance policy, whether for retirement purposes or other purposes]. Nowhere anywhere have I ever in my 27 years in this business, have I ever seen anyone anywhere at any time say that universal life insurance is a good investment strategy. The only people who say that it is a good idea are people in the insurance industry -- the insurance companies who manufacture the products and the insurance agents who sell them [and who sometimes don’t call themselves ‘insurance agents’].” -- Ric Edelman, 5/30/2015

With Whole Life Insurance you will probably end up with a return on investment of only between 3% and 4%.

With Indexed Universal Life you will probably end up with a return on investment of only between 2% and 5% if you hold the policy for life! .

Dave Ramsey will always tell you to go with a TERM life insurance plan.

IMPORTANT LINKS:

http://brokercheck.finra.org/ -- On this website you can research any broker / adviser to see if they have any criminal "events" on their record. Enter their name. Once their name appears be sure to click the "details" button in order to view the report.

As previously mentioned, a fee-only fiduciary adviser legally works for you and your best interests. http://www.napfa.org/ is a nice website that provides a database of these fee-only advisers.