Continued Rebuttal and General Education for the Public

As just an investor with a business review I have recently done a lot of reading and I have learned a lot of things that certain non-fiduciary "advisers" might not have a conversation with you about. Hopefully this public service page will serve to educate all investors. Again I am not a financial adviser of any sort. I am an investor just like you. I have however done a lot of research and have posted reputable links so that you the reader can learn. This page will also serve as my rebuttal to Tom's comments...

CRITICAL: KNOW THE DIFFERENCE BETWEEN A FEE-ONLY FIDUCIARY, A FEE-BASED and A NON-FIDUCIARY

You need a fee-ONLY fiduciary. Understand that "brokers" are legally allowed to call themselves "investment advisers", "retirement planners", "vice president" or just about any other title they can think of that sounds trustworthy. A non-fiduciary may hold various certifications. That too says nothing about what matters most: Are they a fee-only fiduciary paid on a one-time basis? Titles like "financial planner", "investment strategist", "vice president" and other titles might imply that they are working for you and your best interests but if they're not a "fiduciary" then legally they don't actually work for you. They work for themselves or their company according to the very low legal "suitability standard". Brokers (and other non-fiduciary insurance salesmen, bank employees, etc) are legally allowed to choose investments for their clients based on how much commission money they stand to earn (or will make for their company) even though that product may not be the best choice for you. This is an obvious conflict of interest! Brokers, insurance agents and bank employees don't legally work for you. If you want personalized investing advice that is legally in your best interests then you want a fiduciary adviser, and certainly the "fee-only" variety. In fact I have read right on insurance company brochures (that advertise their annuity products) that explicitly state that their agents do not give personalized investment advice. Unbiased personalized investing advice is not free. Get a second opinion from an fee-only fiduciary adviser who LEGALLY works for you and your best interests. That generally means that you need someone like a "registered investment adviser". An RIA is a fiduciary who legally works for you and your best interests -- not himself or his company interests. Be sure that your RIA signs a written fiduciary agreement with you that explains how he is compensated. He or she should only be compensated by you and only you ("fee-only") and on a one-time or one-task basis. This legally prohibits them from being tempted to sell you investments like annuities, limited partnerships, life settlement investments, actively managed mutual funds, promissory notes, non-traded REITS and other so called "retail investments" that pay big broker commissions. Commissions = conflict of interest. These days fiduciary advisers who legally work for their clients are recommending ETF's.

I AND MANY OTHERS SAY BEWARE OF ANNUITIES: According to wikipedia and other sites, the insurance companies that sell annuity contracts pay brokers on average 6% commissions, but as high as 14% when they sell annuity contracts. Brokers also typically earn "trailer fees" as long as their name is listed on your insurance company statements. Brokers earn 2 - 3% on average when selling "actively managed" mutual funds, which are so-called "retail investment products". Mutual funds differ from ETF's or "passively managed" mutual funds which do not pay the huge broker commissions but are vastly cheaper and consistently outperform actively managed mutual funds.

According to the NASD, investors made at least 7,000 complaints about variable annuities in 2003 ALONE!

This study revealed that the so called "tax advantage" of annuities is more than offset by the higher ordinary income tax that you pay later.

Syndicated radio host and fiduciary adviser Ric Edelman has said that annuities are usually on the NASAA's top 10 list of scams, most notably because of the omission of disclosure about costly surrender charges and steep sales commissions. The NASAA is the oldest international organization devoted to investor protection.

If you insist on putting your money into an annuity despite all of the many annuity negatives then I say go with Vanguard because Vanguard annuities are not "retail annuities". As a result, Vanguard annuities have drastically lower fees and no surrender charges. If you are invested in an expensive annuity now then I say switch to Vanguard after the insurance company surrender period has ended. This is done through a tax free 1035 exchange. Click here to see how much you are likely to save in just the first year by switching to Vanguard.

Annuity salesmen sometimes like to make investors to feel comfortable with annuities by mentioning that Federal Reserve Chairman Ben Bernanke owns an annuity. What they aren't telling you is that as Chairman of the Federal Reserve, it is my understanding that he is not allowed to own banking or finance related stocks or funds! That would include many bread and butter index funds like VOO and SPY. My understanding is that since annuities are not classified as "investments" this would allow for him to circumvent the rule and still gain exposure to banking and finance securities.

According to this web site most investors don't know their rights.

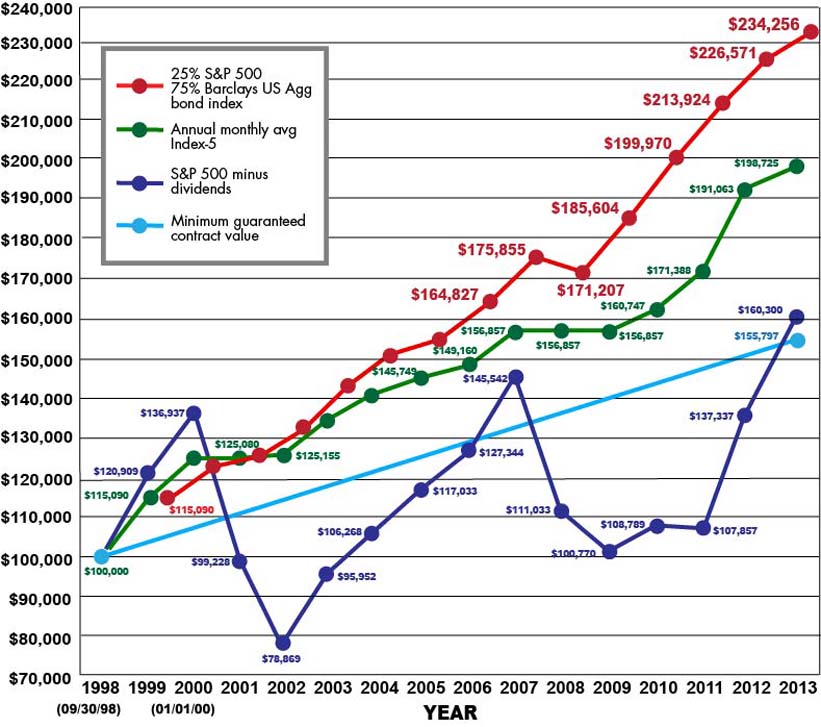

As you can see below, based on this widely publicized hypothetical index annuity return chart, the annuity was easily beaten even during the "lost decade" of the 2000's by a low risk, age-appropriate balanced portfolio that favors bonds. Also the annuity line (below) is not necessarily representational of a cash surrender value or death benefit value, which would determine return on investment, nor does it account for taxes (annuities are taxed at a higher rate). The green line may just be a hypothetical "income base" (AKA "accumulation value") which is merely used to determine interest payments. Surrender charges would certainly adversely effect the cash surrender value if taken out early, and thus adversely affect annuity return on investment. With guaranteed income riders the annuitant's surrender value actually typically incurs hidden, high 3 - 4% fees which further erode the actual return on investment, in which case the 75/25 portfolio would do even better.

This law website has this to say:

Examples of situations where firms have been found liable for excessive and unnecessary fees include: Short-term trading or switching of mutual funds and variable annuities that earn the broker a commission and cause the customer to incur an early termination charge known as a contingent deferred sales charge.

I SAY SWITCH TO VANGUARD

Stuck in an annuity now? Talk to an independent, objective, fee-only adviser. Vanguard annuities have NO surrender fees and are DRASTICALLY lower cost than the retail annuities that broker / adviser / insurance agents sell. Don't expect Mr. Broker to tell you about Vanguard because Vanguard does not pay commissions to broker / agents like all of the other companies that sell annuities do. Your self-serving broker probably earns a 1/4% commission for every year that you remain invested in the expensive annuity that he sold you (as long as you allow his name to be listed on your quarterly statements), so if you talk to him he will try to convince you not to switch to Vanguard. Anyway you can do what's known as a tax free 1035 exchange. So it won't cost you anything as long as the insurance company "surrender period" has ended. You'll just start saving a lot of money! CLICK HERE to see how much you will save in the first year.

WHAT IS CHURNING?

Churning is a fraudulent practice in which a broker makes excessive trades primarily for the purpose of generating commissions and other revenue without regard for the customer’s investment objectives. It is important to note that the broker does not need to have actual discretion over the account. It is sufficient if the broker has actual (de facto) control over the account.

California has had a "suitability rule" for broker-dealers and agents for more than three decades. Rule 260.218.2 provides:

Any broker-dealer and any agent employed by such a broker-dealer who recommends to a customer the purchase, sale or exchange of any security shall have reasonable grounds to believe that the recommendation is not unsuitable for such customer on the basis of information furnished by such customer after reasonable inquiry concerning the customer’s investment objectives, financial situation and needs, and any other information known by such broker-dealer or agent.

More particularly the elements of the fraud are that:

1) The broker have control of the account either by virtue of a formal grant of discretion (a so-called “discretionary account”), OR that he have control in a de facto sense in that he is recommending most if not all of the trades, with a passive or unsophisticated customer who is responsible for few or none of the trades.

2) That the trading is excessive in size or frequency and

3) That the broker is acting willfully, or with disregard for the interests of the customer (the so-called “scienter” requirement).

If you believe that your broker may have churned your account then contact a law firm such as this one to have your case evaluated…

http://www.sokolovelaw.com/legal-help/securities-fraud/lawsuit/fraud-types

Here's another law firm dedicated solely to investor claims and class actions: Click Here

ANNUITIES and MUTUAL FUNDS are not trading vehicles. The purchase and sale of those investments within a short period of time is almost always indicative of excessive trading!!! Contact an attorney within 10 years of the alleged infraction (or questionable behavior) if any investment professional has recommended such transactions.

Research finds that victims of fraud and scams are more likely to be be affluent and college educated. It's not all a bunch senior citizens who are being taken advantage of.

This government web site talks about about knowing your rights when an insurance agent or sales person recommends that you cash out some or all of your stocks, bonds, or mutual funds to purchase an annuity.

I have read that there are so many Limited Partnerships that are scams that it is hard to pick out the good ones. Many brokerage firms refuse to sell them. Another article about limited partnerships defrauding investors. More about limited partnership scams including talk about how the risks are downplayed by the financial advisors selling these products. . It's easy to see from these articles that limited partnerships, master limited partnerships and the like are too risky because it's too hard to differentiate the scams from the legitimate ones.

Home Page | Page 2 | My Review of CT Thames Continued | My Irrefutable Documentation | My Response to C Thomas Thames | Rebuttal to Tom Thames regarding annuities | Links one star review | General tips one star review | Site Map | Tom impugning his former client | Email

© 2012

I am a former client of C Thomas Thames. Anyone with eyes can read that this site is about my review of C Thomas Thames, the investments he sold me and a discussion about various other issues of public debate. Tom has made the assertion that someone might, I would presume, be confused into thinking that this site is run by Tom himself, run by an investment professional, or provides personalized investment advice, which is completely false. It is obvious to anyone that the content offered herein is not personalized recommendations to buy, sell or hold securities, and any content on this site does not constitute individual investment, legal, tax or other professional advice. As they say, always consult with an independent, objective, fee-only fiduciary adviser who legally works for you before making financial decisions. This goes without saying.