MY REBUTTAL TO RESPONSES FROM TOM THAMES

In response to this review, Tom has been notorious for his blatant distortions, contradictions, red herrings and non-denial denials. These are my responses to just a few of his most flailing and deceptive comments. After reading this page you will agree that Tom has about as much credibility as Baghdad Bob.

"This never happened! ....I cannot find or recall any variable annuity surrender charges like you describe."

-- C Thomas Thames

My analysis: This is an actual quote from Tom's March 2012 public response to my old Yelp review. Tom has since changed his tune and says that he couldn't figure out who was writing the review because it was posted anonymously (as Yelp reviewers often do). But let's be get real... he said that he couldn't recall any... that's ANY of the said variable annuity surrender charges. I am truly amazed that Tom Thames really and truly didn’t recognize ANY surrender fees this incredibly massive, the fact that illiquid variable annuities (of all investments) were invested in and surrendered multiple times and in short time periods, etc. Who could forget overseeing a client’s savings in the way mine was handled??? The facts I presented jump out as glaringly beyond out of the ordinary, like a fireworks display in a library, yet Tom said that he didn’t "recall". If Tom in fact pocketed huge sales commissions like I suspect (again I have no proof until I actually see but it is well documented that annuities in general pay huge commissions) then it becomes even more unbelievable that Tom wouldn't remember ANY of this.

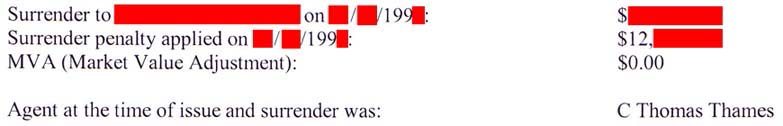

"....He claims that I sold him an annuity and in less than eight months persuaded him to surrender it and pay a $12,000 surrender charge in order to buy another annuity. I absolutely deny that..."

-- C Thomas Thames

This is another actual quote from Tom's December 2011 public response to my anonymous Yelp review. Again Thomas has since changed his tune but not until after I posted documentation that he could not deny. He claims that he couldn't figure out who was writing the review because it was posted anonymously, but let's back up -- Tom used the word "absolutely". Tom even went so far as to suggest that a "competitor" of his might have posted a fake review. In reality it is 100% true that I paid a huge "surrender charge" of over $12,000 when Tom persuaded me to switch from one annuity to another annuity after mere months and processed that transaction. This clearly should not happen because annuities are not trading vehicles. Honestly who could possibly forget such a debacle? Certainly readers can deduce that Tom must have remembered otherwise he wouldn't have used the the word "absolutely". Making matters worse is that at this earlier point in time I was only telling just one part of my story. The full story, which I would later discuss, was much much much worse (5 more surrenders)! For most financial planners, just plain selling one single annuity to a client should be a rare unforgettable event. Respected financial adviser Ric Edelman said on his syndicated radio show that over a span of nearly 25 years he’s only had perhaps about 10 clients who were an appropriate fit for an annuity out of approximately 16,000 clients. That’s about 1 “fit” for every 1,600 clients because he says annuities are such bad investments. And certainly Ric Edelman is not even talking about surrendering annuities -- just selling an annuity to a client one time. Tom sold me (one client) a WHOPPING eight annuity contracts, changing his mind about and recommending that his client surrender six annuities, yet he publicly stated on Yelp that he couldn't remember even just this one. I believe this is just too hard to believe.

FLIP FLOP?

“....[he] has accused me of making unsuitable recommendations many years ago without offering one scrap of evidence to support his claims.” 2/7/2012

-- C Thomas Thames

At this point in time, in my Yelp review I had only described one single surrender penalty of over $12,000 that I paid as per Tom's recommendation to prematurely surrender that annuity contract after mere months. In response to this review Tom then voluntarily described the recommendations that he saw in my old Yelp review as “UNSUITABLE”. This is very important because I didn’t say “unsuitable” -- Tom did!!! So while he was attempting to suggest that the transaction never took place (which I later proved did take place), at the same time I think that he was at least admitting that if and when an adviser recommends a transaction that comes with a $12,000 surrender penalty, this would be “unsuitable” advice. And if so Tom could only be talking about the legal suitability standard. The SEC and FINRA have "suitability" laws that protect investors from unsuitable (illegal) advice.

Now fast forward to the present. Now that I have provided documentation, Tom appears to have backtracked. Tom is now insistent that he did nothing illegal and that there must have been a legitimate "reason" why he made these annuity flipping recommendations. Flip flop.

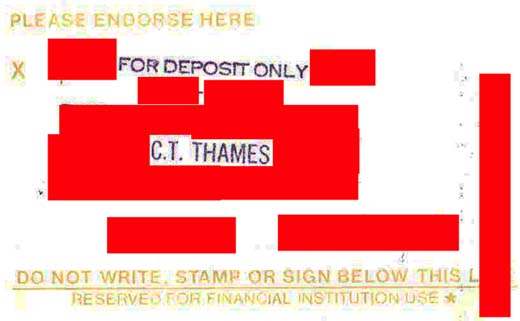

"....He certainly never paid me any investment advisory fees..."

-- C Thomas Thames

After Tom made this statement, I then posted this check image (below) on 12/8/2012. He was paid by me for his financial services. It's a good thing I save paperwork!

"[He is] complaining about something that he is unable to prove and so far he seems unwilling to even try."

-- C Thomas Thames

It doesn't take but two seconds for any reader to look at the irrefutable documentation that I have posted to demonstrate that these annuity transactions did take place, and that I paid huge surrender penalties. This is the central point of my review.

"[He tells] the same story and [he doesn't] provide any proof."

-- C Thomas Thames

This is yet another public statement from Tom Thames that I think is just plain deceptive to readers. Anyone can see that I have indeed posted irrefutable documentation on this web site to support my review. It has been there since 2012.

TOM TRYING TO SUGGEST THAT UP IS DOWN AND BLACK IS WHITE

"...the insurance company records would disprove his [client's] claims."

-- C Thomas Thames

I have already posted the documentation. That documentation says everything because annuities with huge surrender penalites are not trading vehicles and never have been trading vehicles! End of discussion. Ask any investment professional (other than Tom Thames). Tom is again trying to convince people that constantly and repeatedly surrendering annuities after mere months is sound advice.

TRUTH SUPPRESSION TECHNIQUE: DEBATE IRRELEVANT DETAILS

Tom argues that his client “knew what he was doing”

Advisers have a DUTY to make sure that their clients do NOT absorb excessive transaction costs. Yet it looks like Tom is trying to suggest to readers that he would have been somehow relieved of his duties as an adviser if he can just convince readers that his client “knew what he was doing" by determining if the client received a prospectus and closing statement. Nice slight of hand! NONE OF THIS changes an adviser’s duty to avoid excessive transaction costs. Ask any investment professional (other than Tom).

NON-DENIAL DENIAL

"...[the client] waited [many years] to accuse me of making improper and unethical recommendations to exchange annuities; AND he says I failed to tell him about the surrender charges. I deny ALL of that..."

Notice how Tom carefully crafted his response by bundling 2 questions together so that he could deny them both as one, rather than individually denying the one question that matters! The operative words he used are "and" and "all" (highlighted in red above). Instead of individually denying "making improper and unethical recommendations", Tom carefully bundled it with a denial to a question that cannot be definitively proven (what words were said in conversation) unless tapes recorders were running at all times!

Tom is also knocking down straw men. I’ve already covered this to death. What words were said have no bearing on the duty of an adviser to make sure their clients do not absorb excessive transaction costs. Tom is always careful never to discuss this.

He also presents a logical fallacy. He is suggesting to readers that because this happened in the 90‘s it somehow shouldn't be believed. Again this is not a case of Tom said / client said. I have already posted the documentation proof and it has been posted for nearly 3 years!

A LIE AND A DISTRACTION TECHNIQUE TO TRY TO DEBATE MORE IRRELEVANT DETAILS

Tom says “I have never sold an annuity without explaining surrender charges”

Once again, advisers have a duty to make sure that their clients NOT absorb excessive transaction costs REGARDLESS of what conversations did or didn’t take place. Conversations don't change an adviser's duty to avoid excessive trading.

For whatever it's worth to readers, when you look at all of the massive surrender penalties that Tom’s client paid, it is PAINFULLY OBVIOUS that some sort of deception went on because annuities with long surrender periods are not meant to be constantly and repeatedly surrendered! That is the unavoidable truth.And just strictly for fun (because this discussion is irrelevant), if you were to take Tom’s desperate argument at face value (as he suggests that he verbally informed his client of each surrender penalty) then you are STILL left with the same question of WHAT ON EARTH was he doing constantly and repeatedly piling up all of these surrender penalties for his client anyway???? You can just imagine what such a conversation might have been like... “Hi. It’s me Tom. I have once again changed my mind about that annuity that I just sold you a few months ago (at a cost of $12,000) and this exchange will cost you another $17,000 to switch to this other annuity. What do you say?” It's just completely absurd. What should make perfect sense is this story.

Again, MOST IMPORTANTLY at the end of the day, conversations are IRRELEVANT. Conversations don’t change an adviser’s DUTY to make sure that their client does not absorb excessive transaction costs. The transactions speak for themselves by themselves because annuities with long surrender periods of many years are not trading vehicles. Ask any investment professional (other than Tom).I have already stated that it wasn’t until Tom’s final annuity switcharoo that anyone had an actual conversation with me about a “surrender charge”. This much is obvious and there is no need to rehash that.

TRUTH SUPPRESSION TECHNIQUE: CREATE A BUBBLE OF UNKNOWN, IGNORE THE OBVIOUS

Tom has suggested that he “had legitimate reasons for recommending the [annuity] exchanges” and that essentially if HE isn't given access to copies of specific paperwork then there is insufficient proof for readers to come to any conclusions with regard to this review.

The problem with this nonsensical statement is that annuities with long surrender periods are NOT trading vehicles, never have and never will be! CONSTANTLY AND REPEATEDLY LOSING MONEY is not an "investment strategy"! Clearly nobody can even begin to justify the constant and repeated surrendering of variable annuities six times at a cost of over $59,000 in surrender fees. Losing money is not an "investment strategy". Annuities are not and have never been trading vehicles.

TOM TRYING TO SUGGEST THAT UP IS DOWN AND BLACK IS WHITE

Tom says that "from today's point of view" he might have provided "questionable advice"

Leave it to Tom Thames to try and convince people that constantly and repeatedly surrendering annuities after mere months is sound advice. Annuities have NEVER been trading vehicles! Not in the 1990's and not now! It is comical for anyone to suggest otherwise. Ask any securities attorney or registered investment adviser.

TOM BLATANTLY CONTRADICTS HIMSELF

"I am not defending constant and repeated surrender charges or even annuity exchanges"

-- C Thomas Thames

This is another one of Tom's most comical responses that is perfectly reminiscent of "Baghdad Bob", the Iraqi Information Minister who during the gulf war always said the complete opposite of what was reality. Whenever someone says "I am not saying ____ , BUT...." they are saying it. In reading some Tom's responses over the years and looking at the totality of his responses it is obvious that defending constant and repeated surrender charges is what he has done!!!! Tom has been outraged that his client would even talk about these surrender charges, which is amazing! If Tom really wanted to take the position that he has not been defending constant and repeated surrender charges then either Tom needs Cliff Notes or he has been cleverly trying to distract readers away from these transactions because constant and repeated surrender charges is what this review is all about!

TOM AGAIN CONTRADICTS HIMSELF

"I do not and never have considered variable annuities 'trading vehicles'. And the fact that I have recommended a few variable annuity exchanges doesn't mean that I believe they were designed or meant for trading."

-- C Thomas Thames

Another absurd "Baghdad Bob" response from Tom! Constantly and repeatedly recommending that your client surrender six annuity contracts one right after the other at huge surrender penalties, each time after mere months IS treating them as trading vehicles!!!

MORE OF TOM SUGGESTING THAT UP IS DOWN AND BLACK IS WHITE

"All [the documentation] proves is that I was the agent and that he paid surrender charges"

-- C Thomas Thames

A common truth suppression technique is to declare that there's not enough information to come to any conclusions. The problem is that we ALREADY have all of the information that we need! The documentation is EVERYTHING! We ALREADY have proof that Tom constantly and repeatedly treated annuities as trading vehicles! And for anyone who doesn't know it, just ask any financial professional and they will tell you that 1) Annuities are not trading vehicles, and 2) Insurance agents / brokers / advisers are not supposed to treat annuities as trading vehicles. This is the unavoidable truth that is not "subjective" or a matter of opinion as Tom evidently would like readers to believe.

STRAW MAN ARGUMENT

"No one will ever know what was said"

-- C Thomas Thames

Once again Tom is trying to debate a moot point: What words were said. We don't need to hear tape recordings of conversations because we already know that Tom processed the transactions and we already know that annuities are not trading vehicles and that insurance agents / brokers / advisers are not supposed to treat annuities as trading vehicles!

TOM WATERING DOWN WHAT HE DID

"Did I give [my client] questionable advice 20 years ago? In hindsight, maybe I did"

-- C Thomas Thames

Let's review: Tom says that he views the constant and repeated treatment of variable annuities as trading vehicles as merely "questionable", which sounds nice and harmless to a know-nothing reader. It's amazing that someone who has supposedly been doing this since 1975 could even think that. Ask any financial professional about the ridiculousness of Tom's doublespeak.

TOM TRYING TO DEFLECT BLAME & NONCHALANT ATTITUDE ABOUT LOSS OF PRINCIPAL

PLUS A CRITICAL OMISSION

TOM‘S RESPONSE: Tom poses the question, if his client is unsatisfied with annuities, then why haven’t they simply cashed out of the contracts. Tom notes that the “only” thing that might cause his former client to remain invested in the last two annuities that Tom sold them, would be what he says is a “10%” tax penalty, which applies when you pull money out before age 59 1/2.

Thomas freely discards what is actually a 10% Federal and a California state early withdrawal tax withholding penalty as if it’s no big deal. Who in this world treats additional double digit percentage loss of your savings as if it's no big deal??? I found out the hard way when I withdrew some annuity money early and saw that 11% in state and federal taxes had been withheld by the insurance company. I'm not an investment adviser and even I now know that it's more than just the "10%" Federal tax penalty that Thomas could think of. Before I posted this response to correct him, Tom publicly stated that he could "only" think of a "10%" Federal penalty. Tom has since corrected himself, but this didn't occur until after I corrected him on this web page. Additionally there is ordinary income tax to pay later, although this applies at any age.

TOM COMPARING APPLES TO ORANGES

"Investors lose money now and then. That’s the way it works.”

-- C Thomas Thames

If Tom may happen to be trying to somehow rationalize the massive surrender penalties that I paid as a result of his constant and repeated annuity switching recommendations, then he is IGNORING the fact that annuities are not trading vehicles! Constantly and repeatedly paying surrender charges is NOT akin to "losing money now and then"! Tom appears to be comparing trading of liquid investments (like stocks) with illiquid investments (variable annuities with long surrender periods). They are absolutely 100% different! Ask any registered investment adviser as to whether annuities are meant to be constantly treated as "trading vehicles". It's actually very frightening that any adviser would perceive constantly and repeatedly paying contingent deferred sales charge penalties as some sort of happenstance. This to me is just further indication that Tom the "financial services professional" has no concept of the fact that annuities are not trading vehicles. He claims that he does but his words indicate that he clearly doesn't.

TOM TRYING TO MARGINALIZE THE REVIEWER / RED HERRING

TOM‘S RESPONSE: Tom says that his client is "hiding" behind anonymous reviews.

The fact that this review is anonymous is a moot point because the documentation has ALREADY BEEN POSTED! In fact it has been posted since 2012. Yet Thames evidently still wants to suggest to readers that "He's anonymous, therefore he can't be believed". It's comical really.

TOM'S FIXATION ON A MOOT POINT & CONTINUED DISTRACTION

TOM‘S RESPONSE: Tom claims that his client must have received a multi-page legal book called a "prospectus" and he even suggested that it's his client's fault for not discovering it sooner.

Whether the client receives a legal book called a “prospectus”, receives a closing statement, signs the insurance company contract, whether the client is young or old, naive or has some investing experience is ALL irrelevant and moot when we’re talking about the responsibility of the broker, adviser or rep. And just because a client acts on an insurance rep’s advice (ex- to surrender an annuity) this does NOT change the fact that representatives have always had responsibilities to to among other things insure that a client not absorb excessive transaction costs. Imagine if we lived in a world in which advisers / insurance reps had NO accountability simply because the client followed their recommendation! Well rest assured that is NOT how things worked then (or now). That is why regulatory agencies like FINRA and the securities and exchange commission exist. I hope to educate readers that they absolutely have rights. Insurance reps are not supposed to treat annuities as “trading vehicles”. The casual reader should know that if anyone (broker, adviser, insurance rep, or anyone) may happen to sell you securities, you absolutely have rights even if you simply go along with their "advice".

TOM'S PARADOX

Tom says that his client was "an experienced investor"

If Tom is trying to absurdly suggest that a client who agrees to flip annuities 6 times is a sophisticated investor, this is simply laughable. Look no further than the transactions themselves which are self-evident. Again, this is all a moot discussion. It says NOTHING about the duty of an adviser to make sure that his client not absorb excessive transaction costs. It is clearly an attempt by Tom to distract attention away from himself and his duties.

CONTINUED DISTRACTION, ATTEMPTING TO MARGINALIZE THE REVIEWER

Tom says that [his client] "crosses the line when he suggests that only greedy sales people recommend annuities. There are many highly regarded professionals who believe annuities should be considered by anyone who needs to generate income and protect their assets." "...And there is no doubt that certain fixed and income annuities are exactly what some people need"

When you examine the MAJOR faults of annuities (including the ones that Tom mentioned) you quickly realize that his assertions do not ring true. I will let this page and this page serve as the rebuttal. Ric Edelman's list of 15 investments to avoid includes none other than fixed annuities and equity index annuities.

LOGICAL FALLACY & ARGUING A MOOT POINT

"...if he had a legitimate complaint he would have done something about it 15 or 20 years ago."

-- C Thomas Thames

Tom makes the faulty assertion that if someone is wronged then they would 1) certainly be aware of it, and / or 2) if so, do something about it right away, otherwise presumably Tom is suggesting that either it didn’t happen or it is not possible that he did anything wrong. Anyone who believes this has probably never read this web site (Read the 7th paragraph that starts with the word "unfortunately". Logic says that the complete opposite argument should be made -- that something REALLY wrong must have happened if a client is speaking out years later. Very often it isn't until years later that investors find out the truth of what happened, especially with annuities.

Most importantly it is a MOOT POINT to debate as to why it took the client so long to speak out because I have already provided PROOF that it DID HAPPEN! This documentation has been posted since this site was launched to prove the surrender penalties that I paid.

For what it's worth, I was obviously an unsophisticated investor otherwise I would never have gone along with Tom’s money losing recommendations. For someone to believe that a client knew something wrong had happened, you would also have to assume that the client wanted to lose money! Nobody wants to lose money! Especially in this manner (aggressive trading of non-trading vehicles). So Tom's argument amounts to a logical fallacy (truth suppression technique).

For the record I did file a complaint with the Securities and Exchange Commission (SEC). Tom knows this because I wrote about it in my old Yelp review. The SEC was powerless to review my case only because of the statute of limitations. Does filing a complain too late automatically make it not "legitimate" as Tom has asserted? Absolutely not!!!! Annuities are not trading vehicles. Period!

IN THE END, THE TRANSACTIONS THEMSELVES ARE THE ONLY THING THAT MATTERS

Tom has focused in on a cleverly distractive debate about all sorts of lengthy and irrelevant details such as what conversations took place leading up to these constant and repeated annuity surrenders that he recommended. What he conveniently ignores is that whatever conversations took place are irrelevant because 1) annuities are not trading vehicles, and 2) advisers have a duty not to treat annuities as trading vehicles, yet 3) Tom went ahead and processed all of these costly transactions anyway!

Readers have to question if Tom was truly serious about letting the truth be known and not deliberately trying to mislead readers he would contact the Sacramento Bee and the Wall Street Journal to do a story about what he did! But I can guarantee readers that Tom will never ever do that because he knows full well what an unbiased article would tell. I welcome the Sacramento Bee and the Wall Street Journal to each do full stories about Tom's constant and repeated advice to treat my annuities as trading vehicles.

CLICK HERE to continue reading

Home Page | Page 2 | My Review of CT Thames Continued | My Irrefutable Documentation | My Response to C Thomas Thames | Rebuttal to Tom Thames regarding annuities | Links one star review | General tips one star review | Site Map | Tom falsely impugning his former client | Email

UPDATE: I don’t know who Tom is responding to, but actually it’s irrelevant. We can examine his responses in the general sense just the same, make general references (example "[his client]"), etc. This goes for discussions on this entire site.

I am a former client of C Thomas Thames. Anyone with eyes can read that this site is about my review of C Thomas Thames, the investments he sold me and a discussion about various other issues of public debate. Tom has made the assertion that someone might, I would presume, be confused into thinking that this site is run by Tom himself (or his Thames Financial and Insurance Services), run by a registered investment advisor, or provides personalized investment advice, which is completely false. It is obvious to anyone that the content offered herein is not personalized recommendations to buy, sell or hold securities, and any content on this site does not constitute individual investment, legal, tax or other professional advice. As they say always consult with an objective, fee-only adviser before making financial decisions. This goes without saying.

© 2012