HOW TRADITIONAL INVESTMENTS PERFORM DURING TERRIBLE MARKET CONDITIONS: JUST FINE!

Let's take a look at why stocks and bonds are not as risky as you may have been led to believe. Let the statistical data speak for itself.

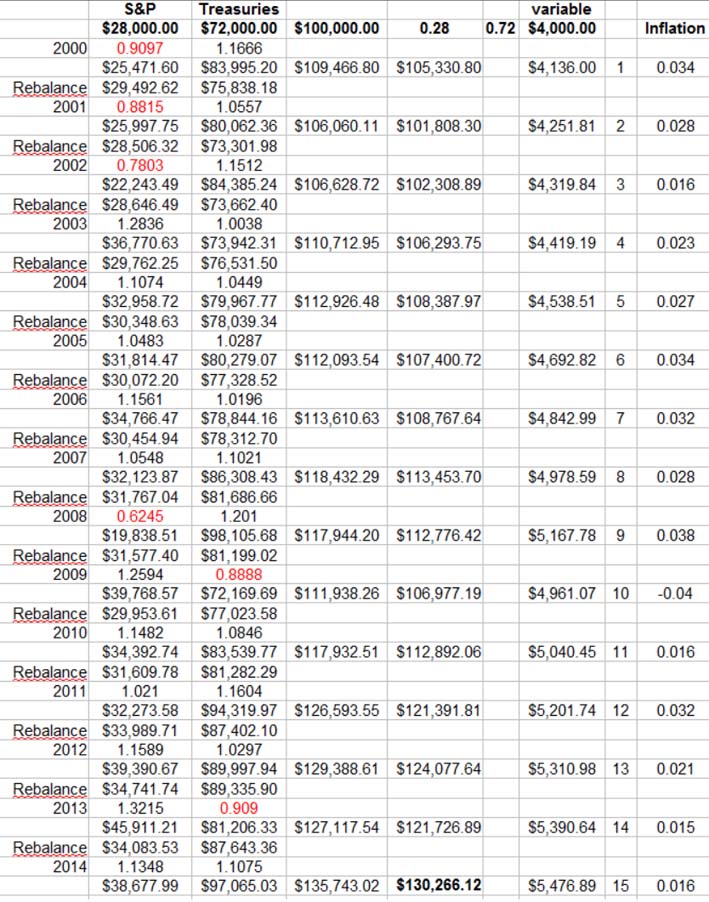

If you invested $28,000 in an S&P 500 index fund (like SPY or VOO) and $72,000 in 10-year treasuries on Jan 1, 2000, rebalanced on January 1st of every year, and took out 4% per year, while adjusting those 4% annual withdrawals to the average annual rate of inflation for each year, your money grew and compounded. It did not lose value, run dangerously low or anything like that. Eventually you were taking out about $5,476. And this was during one of the worst of times! Imagine how well you would do during just average times!

And the experts have said that once you get to a 20 year investing time horizon you can take out 5.1% to 5.5% (not just 4%). So by 2014 you could be taking out $6,643.57 and still have a nice nest egg to leave your heirs or charity!

Home Page | Page 2 | My Review of CT Thames Continued | My Irrefutable Documentation | My Response to C Thomas Thames | Rebuttal to Tom Thames regarding annuities | Links one star review | General tips one star review | Site Map | Email one star review

© 2012